Major Reform: Foreign Ownership Law Now in Effect

Saudi Arabia has officially opened its real estate market to foreign buyers under a landmark law that took effect on January 22, 2026. This reform is a historic milestone and signals a strategic opening of the Kingdom’s property market to global investors, residents, and entities.

Under the new framework:

- Foreign individuals and companies can now apply to own property across approved zones via the Saudi Arabia Real Estate digital platform.

- Residents can apply directly through the portal using their residence permit.

- Non-residents submit applications through Saudi embassies or consulates abroad to obtain a digital ID before completing the process online.

- Ownership remains restricted in Makkah and Madinah, consistent with specialized regulatory protections in those cities.

This reform is expected to boost investment, improve real estate liquidity, and attract international developers, supporting growth across residential, commercial, industrial, and tourism real estate sectors.

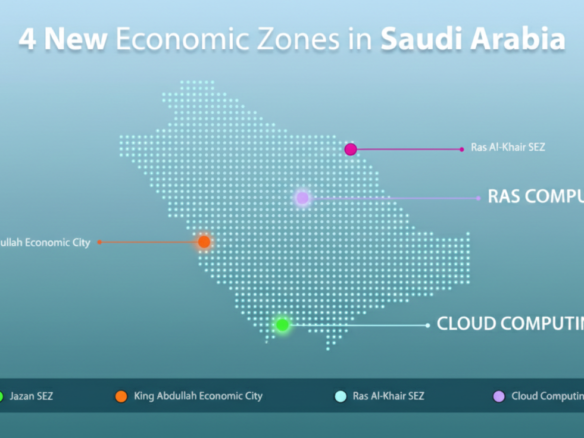

Mapping the Future: 170 Ownership Zones in the Kingdom

Saudi authorities are preparing to define approximately 170 geographic zones where non-Saudi buyers will be allowed to own property or acquire real rights. These zones are expected to include major cities such as Riyadh and Jeddah, as well as governorates across the Kingdom.

The upcoming geographic scopes document will provide:

- Detailed maps and boundaries of permitted ownership areas

- Types of property rights allowed

- Duration and regulatory controls for foreign ownership

This reinforces transparency and helps investors pinpoint opportunities with regulatory clarity.

Real Estate Price Index Shows Slight Softening

Recent data indicates the Saudi Real Estate Price Index recorded a modest decline of 0.7% in Q4 2025 compared to the same quarter in 2024.

Key details include:

- Residential sector prices saw a 2.2% total drop over the year.

- Apartment and villa price segments contributed to this softening trend.

Although this is the first annual price contraction in several years, market analysts view it as a natural recalibration rather than a fundamental downturn — potentially creating more balanced opportunities for buyers and investors.

Growing Residential Pipeline in Riyadh

According to industry reports, Riyadh’s residential development pipeline is expanding rapidly, with an estimated 57,000 new residential units planned for delivery in 2026–2027.

Highlights include:

- Strong quarterly transaction growth in Riyadh, Dammam, and Jeddah in 2025.

- Significant rent increases year-on-year in prime residential segments.

These trends suggest that demand remains robust, and the market is preparing for substantial new supply — a positive sign for both domestic and foreign investors.

Long-Term Growth Projections

Industry forecasts indicate Saudi Arabia’s real estate market could grow to reach USD 137.8 billion by 2034, with a compound annual growth rate (CAGR) of around 6.7%.

This projection reflects:

- Strong fundamentals

- Economic diversification under Vision 2030

- Rising demand in residential and commercial segments

What This Means for Investors

The convergence of new ownership laws, planned geographic zones for foreign buyers, and ongoing residential expansion positions Saudi Arabia as one of the most dynamic real estate markets in the Middle East this year and beyond.

Whether you’re a foreign investor, developer, or homebuyer, these latest developments signal a transition toward greater openness, transparency, and long-term opportunity in the Kingdom’s property landscape.

Join The Discussion